HDFC Zero Balance Account is specially designed for farmers and students. So that farmers can continue their accounts without leaving the minimum deposit.

Farmers help enter the financial industry through this account. IVR No Banking is available free for accountants.

To promote paperless and convenient transactions, as well as cash withdrawals, HDFC Savings Account offers free foreign debit cards to account users.

Providing this foreign debit card to access Net Banking, Mobile Banking, Phone Banking, and Branch Banking Accounts.

Full Guide To Open HDFC Zero Balance Account Online

Are you searching for an hdfc zero balance account opening online without a pan Card? Ok! I will provide full information to start hdfc zero balance account opening online without a pan Card Step By Step.

How to open hdfc online account opening zero balance in India’s number one bank? Yes, guys, you are hearing right. How to open a zero balance savings account in HDFC Bank? Even sitting at home.

Through this post, I will show you all the processes to open a zero balance account in your HDFC bank. You can do this online at home with the help of a mobile or computer.

A worm will be sent to your home within a few days after applying. Etiquette includes a chequebook, passbook, ATM card, etc. Whatever you get for opening a savings account, you get those things after opening a zero-balance account.

You don’t have to spend a single rupee on this. HDFC Zero Balance Account Maintenance No Charges. So let’s start with how you can open HDFC Savings Account with a zero balance.

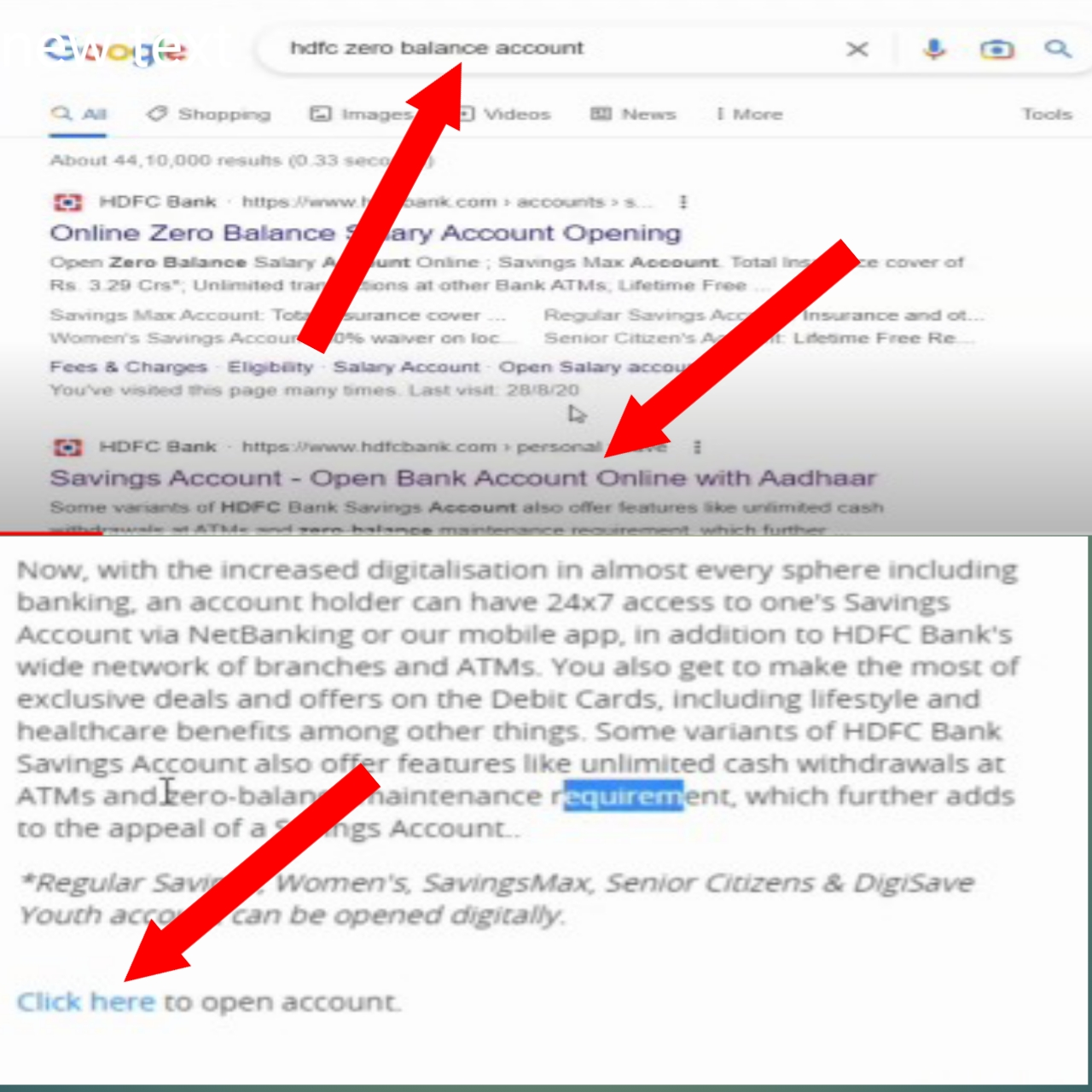

First of all you need to come to the chrome browser and search here “HDFC Zero Balance Account“. Here you will get the second link. Where it will be written, “Open Bank Account Online with Aadhaar”.

- Search On Google “HDFC Zero Balance Account“

- Click On the Second Link

- Click here “Click Here” button

Click this link. After clicking you will be taken to a page. On this page, it will be written Savings Account – Open Savings Account Online. Here are some of the terms and conditions of this account relationship.

You should read them carefully. Two things are most important in this tension condition. One is the zero balance maintenance requirement. That means you don’t have to pay any maintenance charges in a year.

And the second one is unlimited ATM transactions free. No bank gives such a facility. If you scroll down the score below, you will see “Click Here” written. Click on this “Click here” option. You will then be taken to a page.

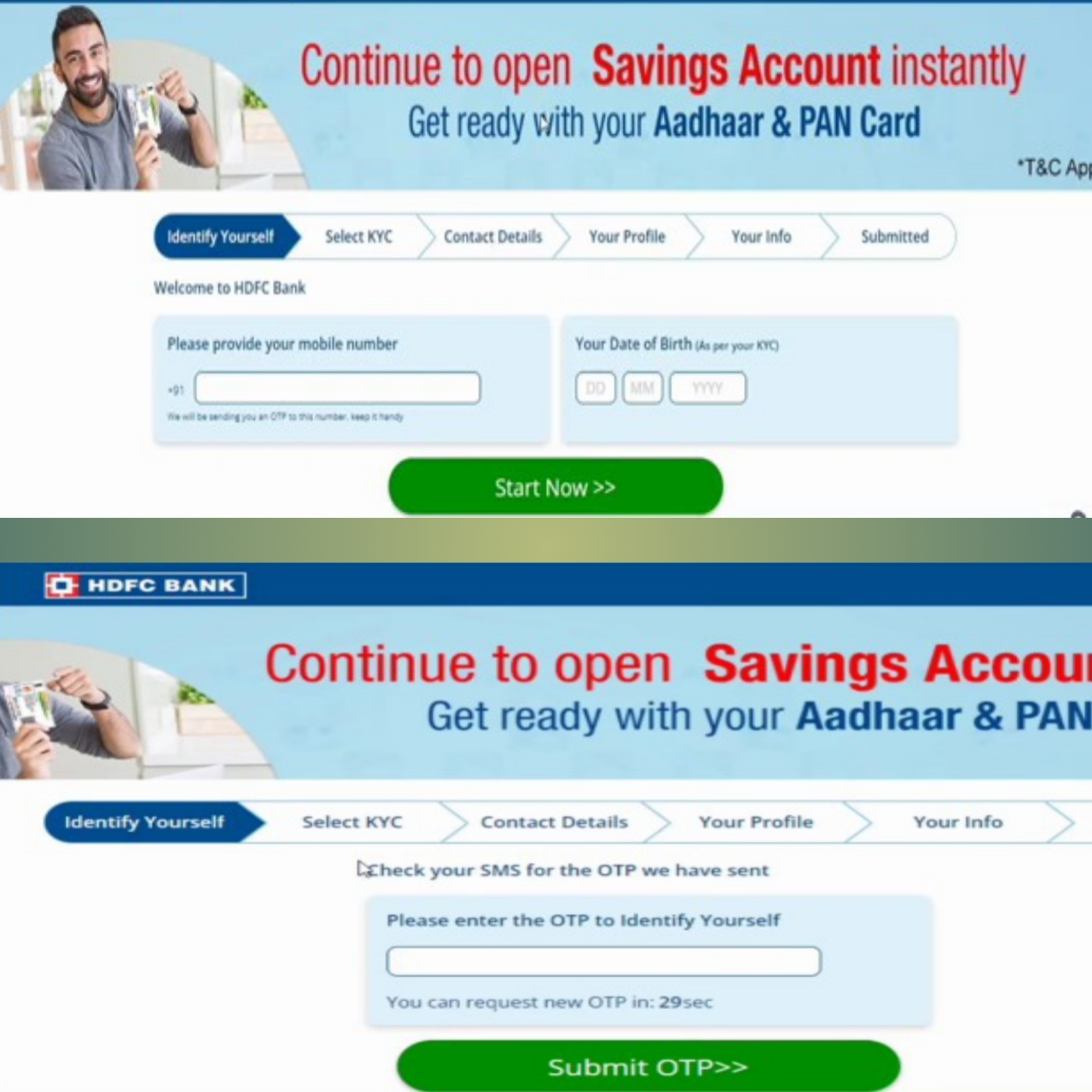

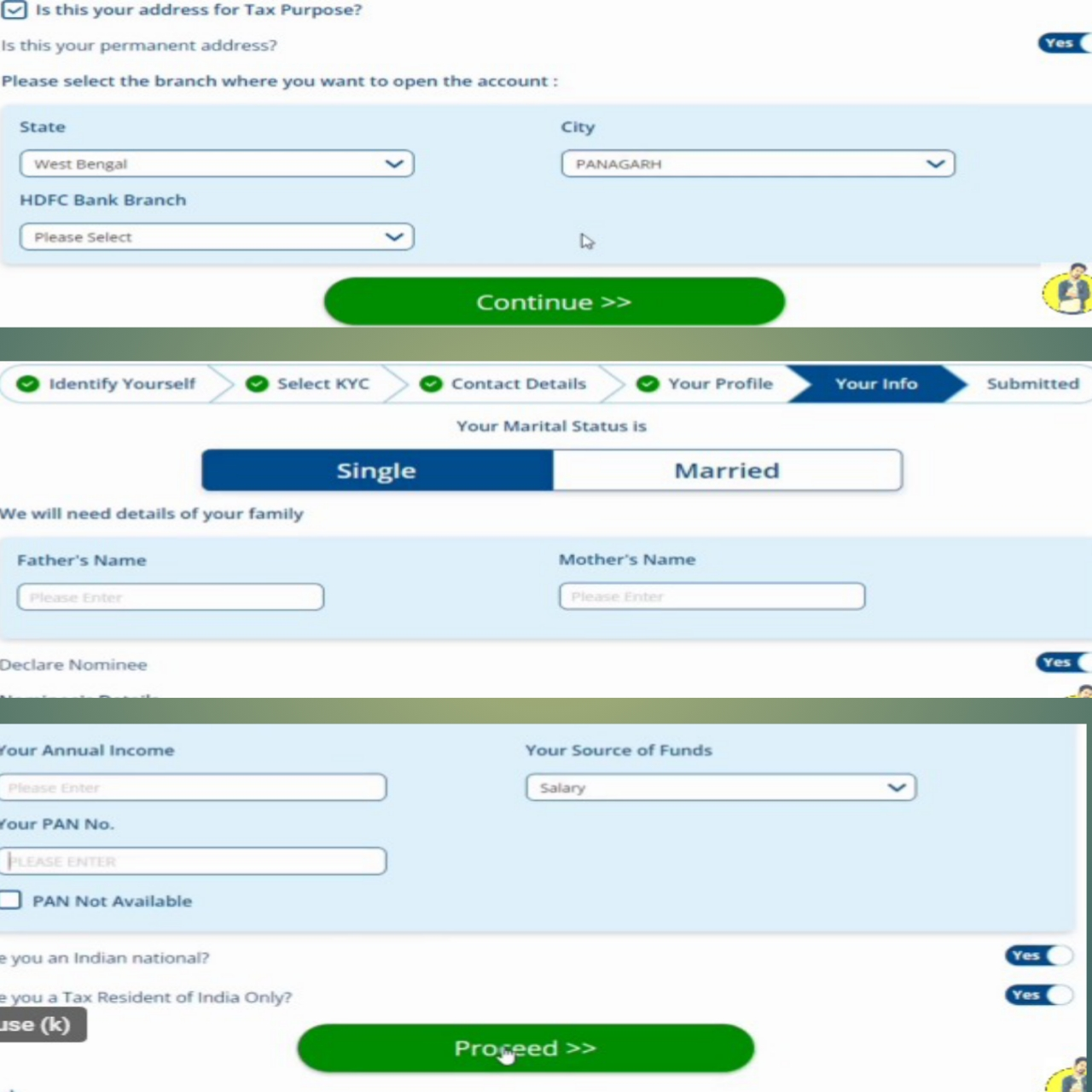

On this page, you will enter your mobile number and enter your date of birth and click on the start now button. Then another page will open.

- Enter mobile number

- Date of birth

- Enter OTP

On this page, you will enter the name on your Aadhaar or PAN card. Then click on the “Get OTP” option. Then another page will open.

OTP will be sent to the mobile number which is linked with the Aadhaar card on this page. After verifying the OTP another new page will open. Here it will show the option named Select KYC.

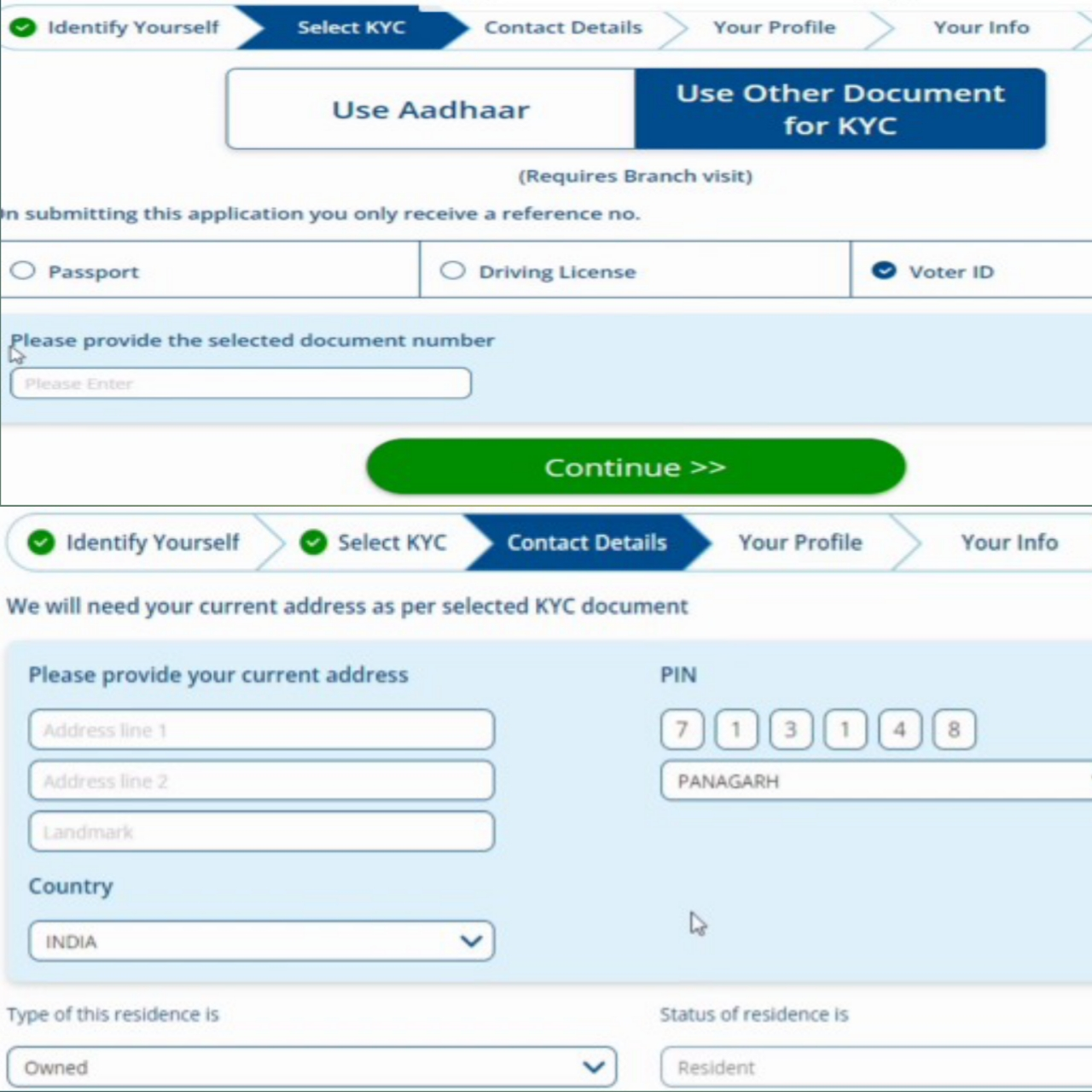

Then the “Use Other” option will show here. Click on this option. Then an Otip will be sent to your Aadhaar-linked mobile number. Enter OTP and verify. Another option will show next to it.

That is “Use their documents for KYC”. After clicking a pop-up will open in front of you. Below it will be written, “Manually upload documents”. Click on this option. After clicking on this option, the following three boxes will open.

- Click on “use other document for KYC”

- Tick Voter Id

- Fill up your address

One is the passport, driving license, and voter ID. You can verify by either. Here the voter id will click on the continue option. After that, a page will open in front of you.

This page will say “Please verify your address details”. This page will show the name and date of birth on your voter ID card. Then fill in your full address here. After filling in everything click on the continue option.

After that, another page will open. Will you open an account next? Savings Account, Current Account, Corporate Salary. These three accounts will show in front of you.

Click on Savings Account. All details will automatically be in a checkbox after filling. Tick this check box and click on proceed option. Then another page will open in front of you.

- Click on continue button

- Tick on Single Option

- Fill up the full details

- Click on proceed button

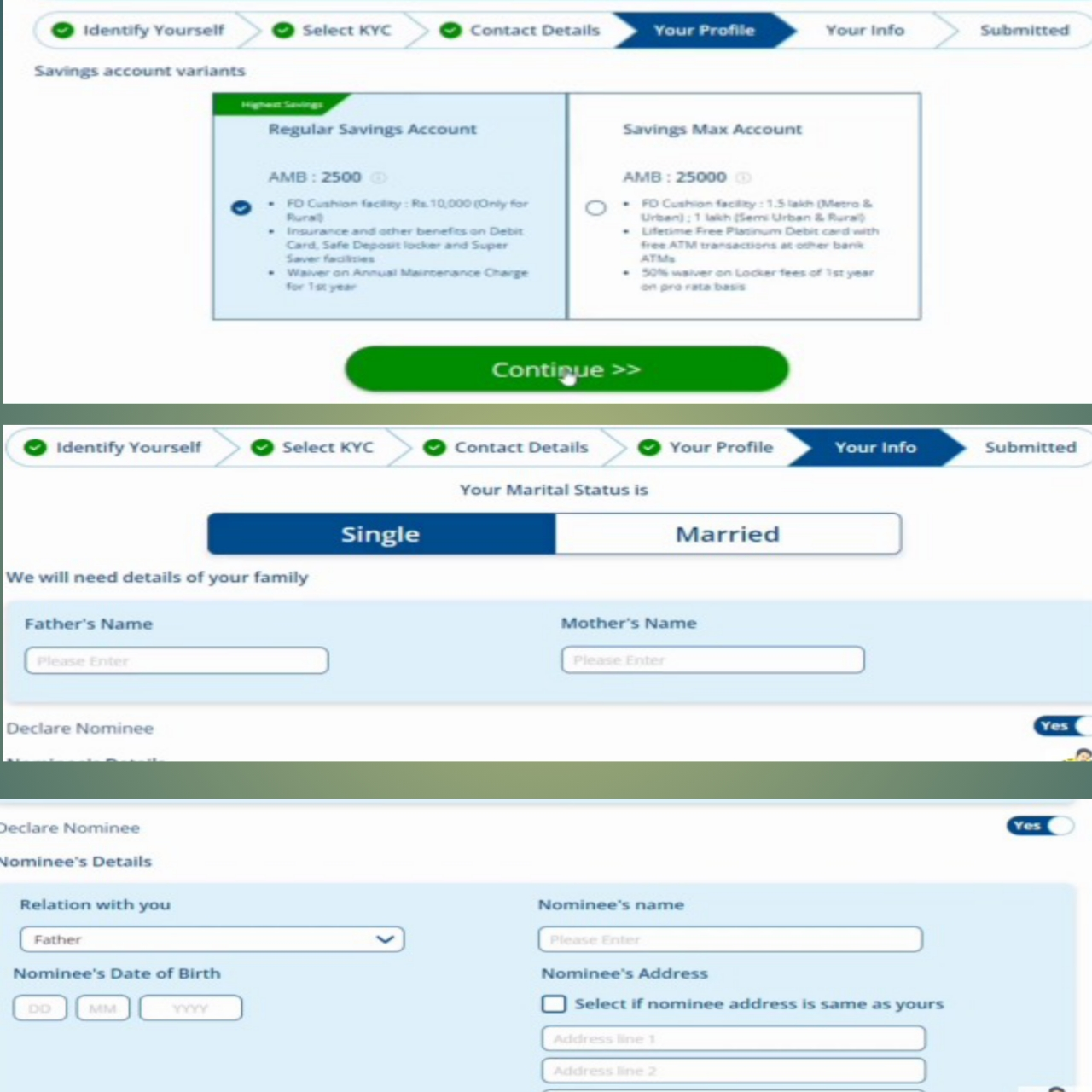

Two accounts will show in front of you. One is a Regular Savings Account and the other is Savings Max Account. Then you will tick the regular savings account and click on the continue option.

Then another page will open in front of you. Here your material status option will show. Two options will show one single and the other married. So if you are single then click on single and if you are married then click on married.

- Click on Regular Savings Account

- Fill up the Full Nominee Information

Then enter the father’s name and mother’s name below. Then do the below. Must add flexibility. You can also edit after nomination. If you don’t want to fill the nominee then an option will show here.

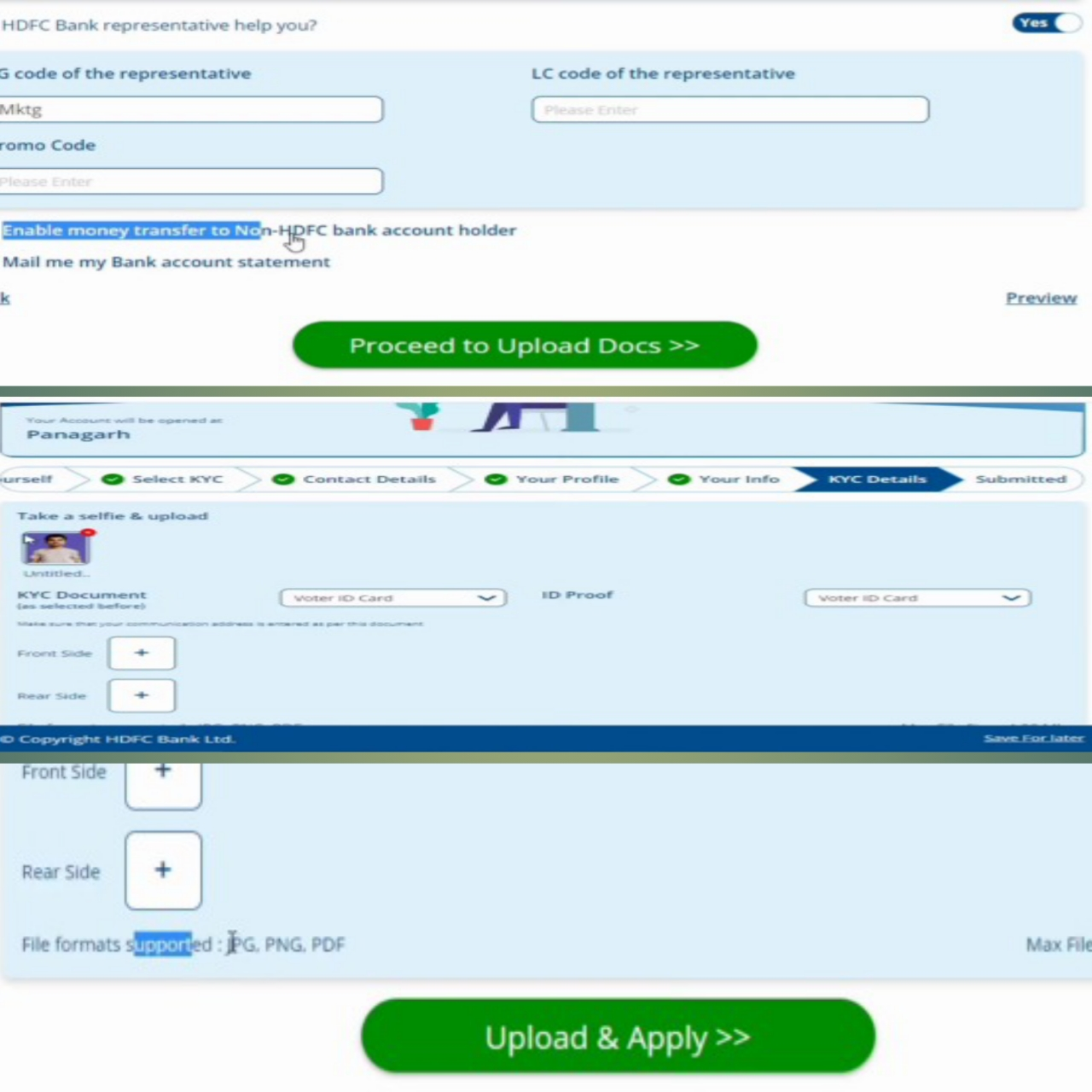

Fill in your birthplace below. After filling in all the details you will get your own two boxes. Click on the option “Proceed to Upload Docs” by ticking the two boxes.

After clicking, a new page will open in front of you. Here are the KYC details you need to fill up. Upload your selfie photo here. Front and back photos of voter ID cards should be uploaded.

Voter ID card is sealed in ID proof option. Then click on the “Upload & Apply” option. After that, you have to select a date for KYC verification. On that date, customer care will do online verification.

- Upload your picture

- Upload your Voter id

- Click on Upload & Apply button

Proper light camera for online verification everything should be fine. For bank account opening which documents, you have submitted before? Keep them with you.

And keep your own signature on white paper. Once online verification is done, then your account will be fully opened.

HDFC Bank will send you a little welcome kit within a few days after opening a zero balance account. Like the post. Stay connected with us.

Also Read: Step By Step Kotak 811 Account Apply Online

Features and Benefit Of HDFC Zero Balance Account

Important features of the HDFC Zero Balance Account are discussed.

- 1. Get a safe deposit locker and super benefits hdfc zero balance account.

- 2. HDFC Savings Account Scheme offers different options to meet different requirements.

- 3. This bank offers complete banking solutions. thereby allowing the customer and his family to benefit from a single account.

- 4. Grounder will get benefits like health and investment etc. through just one savings account. And can enjoy all the daily banking solutions.

- 5. ATMs are spread all over the country to meet all banking needs of this bank.

- 6. Offers facilities like free net banking, mobile banking, and phone banking. Which is very important to people in daily life.

- 7. Email account statements are sent on a monthly basis.

- 8. Some savings accounts offer a “money maximizer” (sweep-out) facility. 1,25,000 so that surplus funds can be placed in high-yielding fixed deposits at a threshold of Rs.1,25,00.

- 9. Provides free Facebook benefits to all personal account holders

- 10. Enjoy free cash and check deposits at branches and ATMs.

- 11. Access your account by card for free.

- 12. Maximum four free withdrawals per month through any mode (including Branch/ATM, NEFT, RTGS, IMPS, Clearing, DD/MC issue, etc.). After the 5th withdrawal, the regular savings account itself is charged.

- 13. Free lifetime bill payments.

- 14. Free Insta Quarry facility.

- 15. Free email statements.

- 16. Enjoy the convenience of checking your account balance through phone banking, mobile banking, or stopping check payments through SMS.

- 17.No minimum balance required.

- 18. Simple transaction.

- 19. No initial deposit is required to open an account.

- 20. No house is required to maintain a monthly balance.

- 21. There is no charge for non-maintenance of the account.

- 22. An inactive account is not charged for everything.

- 23. Free International Debit Card.

- 24. First checkbook is free.

- 25. Cash deposits can be made free of charge without any limit.

- 26. Cash is free up to four times per month and thereafter tax is limited to Rs.50 per transaction.

Also Read: Step By Step Axis Bank Zero Balance Account Opening Online

HDFC Zero Balance Account Eligibility Criteria

- You must hire such a corporation. Who has a salary account relationship with HDFC Bank?

- You should not have any other bank account in HDFC Bank.

- You should not have a BSDB account with any other bank.

- The account can be opened jointly or jointly, by minors under natural/legal guardianship aged ten years and above.

- Resident Individual (Single or Joint Account)

- Hindu guardian’s undivided family.

- For Foreign Nationals resident in India – If you are a foreign national resident in India, you can open a savings account by attaching a QA22 form stating the source of the loan and a copy of your residence permit.

Also Read: Top 5 Bank 0 Balance Account Opening Online For Free

Documents Required To Open HDFC Zero Balance Account

Here discussed the important documents required to open a bank account for students in HDFC Zero Balance Account.

- Examples of proof of identity and address are a completed application form

- Valid passport

- Voter ID card,

- PAN card,

- Permanent driving license,

- Aadhaar card,

- NREGA employment card, or ID card issued by federal or state government,

- PSUs-designated commercial banks are examples of identity and address proof.

- Most recent passport-size photograph.

HDFC Zero Balance Account Charges

Do you want to open HDFC zero balance account? Before opening a zero balance account, it is important to know how much money is charged for each item.

HDFC zero balance account maintenance at no charge. Since this is HDFC zero balance accoun, there is no need for money maintenance.

Such as debit cards, passbooks, chequebooks, credit cards, internet banking, mobile banking, etc. For all these, you have to pay some charges. First of all, I will discuss HDFC Bank Debit Card.

HDFC Zero Balance Account Debit Card Charges list

| Debit Card | Annual / Renewal Fee / Add-on Card Annual fee (joint account holders only) |

| JetPrivilege HDFC Bank Debit Card | Rs. 500 + applicable taxes. First-year free for HNW customers (Classic, Preferred, and Imperia) & select corporates |

| Platinum Debit Card** | Rs. 750 + applicable taxes. |

| Times Points Debit Card** | Rs. 650 + applicable taxes. |

| Millennia Debit Card** | Rs. 500 + applicable taxes |

| Rewards Debit Card** | Rs. 500 + applicable taxes. |

| Business Debit Card** | Rs. 250 + applicable taxes. |

| Woman’s Advantage Debit Card** | Rs. 200 + applicable taxes. |

| Rupay Premium Debit Card** | Rs. 200 + applicable taxes. |

| Money Back Debit Card** | Rs. 200 + applicable taxes. |

| Rupay NRO Debit Card** | Rs. 200 + applicable taxes. |

| ATM Card | Free |

Phased Out Variants

HDFC Bank provides various types of debit cards. Likes Platinum Debit Card, Debit Card provides many types of debit cards. Below is the list chart of all types of HDFC Bank Debit Cards.

| Gold Debit Card** | Rs. 750 + applicable taxes. |

| Titanium Royale Debit Card** | Rs. 400 + applicable taxes. |

| Titanium Debit Card** | Rs. 250 + applicable taxes. |

| Pro-Gold Debit Card** | Rs. 250 + applicable taxes. |

| EasyShop Debit Card** | Rs. 150 + applicable taxes. |

| NRO Debit Card** | Rs. 150 + applicable taxes. |

Every year HDFC Bank provides a 25-page checkbook free of charge. After that, if you need chequebook then charge 100 rupees for each chequebook. And this chequebook has 25 pages.

To get the chequebook of senior citizens, one has to pay 75 rupees for the chequebook. Free Email Statement from HDFC Bank is provided for free.

HDFC Bank also provides an SMS alert statement service. After Rs.15 charges for four months of SMS alert. HDFC Bank also provides IMPS, Internet Banking, and Mobile Banking facilities.

If you transfer funds through IMPS, each transaction costs you 3.50 rupees+ GST (0-1000). If you transfer Rs 1001-100000 then Rs 5 rupees+GST will be charged.

If you transact through IMPS for Rs 5 lakh online then you will be charged Rs 15 rupees+GST for each transaction. There is no charge for HDFC Bank mobile banking.

It’s all free. But if you transfer money through UPI you have to pay charges. Transfers from Tk 1 to Tk 25,000 will incur a charge of Tk 3 plus GST per transaction.

Transfers between 25,000 to 1 lakh rupees will be deducted at 5 rupees per transaction.

Also Read: All India Supported 5 Navi Loan Customer Care Number

HDFC Zero Balance Account Maintenance Charges List:

| Minimum Balance Requirements | Nil |

| Charges applicable for non-maintenance | Nil |

| Chequebook | 25 cheque leaves per financial year Additional checkbook of 25 leaves will be charged @ Rs 100/- (Rs.75 for senior citizens) |

| Balance Inquiry At Branch | Free |

| Balance certificate | Current year – Free; previous year – Rs. 50 ( w.e.f Aug 01, 2021 – Rs.100, Senior citizen – Rs.90) |

| TDS certificate Free | Free |

| PhoneBanking – IVR / Non IVR | Free |

| ATM / Rupay Debit card | Free |

| Debit Card PIN regeneration charge | Rs. 50 (plus taxes as applicable) |

| BillPay | Free w.e.f 1st August’2011 |

| InstaPay | Rs. 10 (plus taxes as applicable) per transaction |

| InstaAlert | Email – Free SMS – Rs. 3/- per quarter, effective 1st July 2021 (plus taxes as applicable) |

| Visa Money Transfer | Rs. 5 (plus taxes as applicable) per transaction |

| NEFT Charges – Inward | Free |

| RTGS – Inward | Free |

| IMPS (Immediate Payment Service) – Inward | Free |

| Cash withdrawals at Home / Non-Home Branch ( self / third party) | 5th transaction onwards – Rs.150/- per transaction (plus taxes) Third-Party Cash transactions’ upper limit is Rs.25,000/- per day Above Rs.25,000 – Not allowed |

| Local cheques deposited for outstation accounts | No charge |

| MobileBanking | Free |

| NetBanking | Free |

| ATM / Debit Card – Transaction Charge | Cash withdrawal – Rs. 20 plus taxes per transaction Non-Financial Transaction – Rs. 8.5 plus taxes per transaction |

| NEFT charges – outward (Branch) | Up to Rs. 1 lac – Rs.2 (plus GST) per transaction Above Rs.1 lac – Rs.10 (plus GST) per transaction |

| RTGS charges – outward (Branch) | Rs. 2 Lac & above – Rs. 15 (plus GST) per transaction |

| IMPS – Outward | Charges Effective January 01, 2017 Amount Rs 1 to Rs 1,00,000 —-Rs.5/- (plus taxes) per transaction Amount above Rs 1,00,001 to Rs 2,00,000 —-Rs.15/- (plus taxes) per transaction |

| RTGS – Outward (online) | Free (effective 1st Nov’17) |

| NEFT Charges- outward (online) | Free (effective 1st Nov’17) |

HDFC Zero Balance Account Minimum Balance

For HDFC zero balance account No minimum balance is required. HDFC Zero Balance Account is generally designed keeping farmers or school students in mind.

There is no payment to be made while opening this type of account. This is the attraction for customers. It is not just for farmers or students. Anyone can open an account.

FAQS

Can we open HDFC Bank account with zero-balance?

Yes, Zero Balance Savings Account can be opened in HDFC Bank. A zero balance savings account can be opened by any resident in this bank. It is not necessary to pay the minimum maintenance charge. After opening HDFC Savings account you will get an atm, passbook, and debit card all free. More Information

What is the minimum balance for HDFC zero balance account?

No deposit is required to open HDFC Zero Balance Account. It is a completely zero balance savings account. There is no maintenance charge for this account. Such accounts attract paying customers. More Information

Does zero balance account have ATM card?

HDFC provides free ATM cards/debit cards after opening a zero balance savings account. There are no monthly or yearly charges for this ATM card/debit card. You can use this debit card unlimited. This debit card or ATM card can be used for World Cup transactions. This is the feature of HDFC Zero Balance Savings Account. More Information

What is the disadvantage of zero balance account?

The disadvantage of hdfc zero balance savings account is the deposit limit. As a rule, most district savings accounts in India have deposit limits. This means you can deposit cash only up to a certain limit. That is one lakh rupees. If you want to deposit more than one lakh rupees, you need to change the zero balance savings account from zero accounts to a savings account. More Information

Can I keep money in zero balance account?

Yes, you can keep money in zero balance savings account. The deposit limit here is up to one lakh. If you want to save more than one lakh rupees, you have to open a savings account. A zero-balance savings account does not require a deposit amount. But to increase savings, funds can be deposited into it. More Information

Conclusion

You can open HDFC zero balance account. No money is required to open this type of account. Monthly, Yearly No charge.

You can open HDFC Zero Balance Savings Account from the comfort of your home with the help of a mobile or computer. And video KYC will be online. So there is no tension in opening an HDFC zero balance account.

You will get a free ATM card from the bank. You can do unlimited transactions through ATMs. No charge will be made for it.

Comments are closed.